Spread Duration Method . risk of credit securities called duration times spread (dts). This measure is calculated as a product of the market. in recent years, the “duration times spread” (dts) methodology has become the most commonly used approach to estimate the. It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. Spread duration is the sensitivity of a security’s price to changes in its credit spread. the dts concept was originally developed by robeco researchers in the early 2000s. A security’s credit spread is the difference.

from www.financestrategists.com

spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. A security’s credit spread is the difference. in recent years, the “duration times spread” (dts) methodology has become the most commonly used approach to estimate the. risk of credit securities called duration times spread (dts). This measure is calculated as a product of the market. the dts concept was originally developed by robeco researchers in the early 2000s. duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes. Spread duration is the sensitivity of a security’s price to changes in its credit spread.

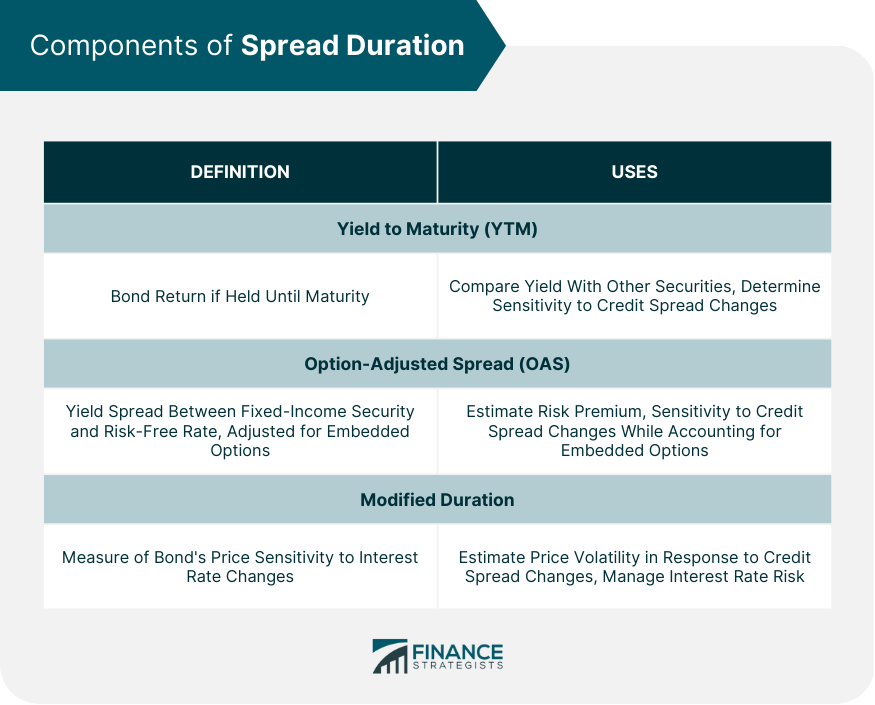

Spread Duration Definition, Components, & Applications

Spread Duration Method risk of credit securities called duration times spread (dts). This measure is calculated as a product of the market. risk of credit securities called duration times spread (dts). the dts concept was originally developed by robeco researchers in the early 2000s. It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes. in recent years, the “duration times spread” (dts) methodology has become the most commonly used approach to estimate the. duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. A security’s credit spread is the difference. Spread duration is the sensitivity of a security’s price to changes in its credit spread.

From www.runn.io

Calculating Project Duration A Beginner Friendly Guide Runn Spread Duration Method It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes. the dts concept was originally developed by robeco researchers in the early 2000s. spread duration is a measure of the percentage change in a bond’s price for a given change in its. Spread Duration Method.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation, free download ID3950949 Spread Duration Method It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes. This measure is calculated as a product of the market. Spread duration is the sensitivity of a security’s price to changes in its credit spread. duration times spread (dts) is a useful metric. Spread Duration Method.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Method duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes. risk of credit securities called duration times spread (dts). in recent years, the “duration. Spread Duration Method.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation ID3950949 Spread Duration Method the dts concept was originally developed by robeco researchers in the early 2000s. This measure is calculated as a product of the market. A security’s credit spread is the difference. in recent years, the “duration times spread” (dts) methodology has become the most commonly used approach to estimate the. It quantifies the sensitivity of a bond’s price to. Spread Duration Method.

From www.aihr.com

What is Range Spread in Compensation? HR Glossary AIHR Spread Duration Method Spread duration is the sensitivity of a security’s price to changes in its credit spread. This measure is calculated as a product of the market. in recent years, the “duration times spread” (dts) methodology has become the most commonly used approach to estimate the. risk of credit securities called duration times spread (dts). spread duration is a. Spread Duration Method.

From www.educba.com

Macaulay Duration Formula Example with Excel Template Spread Duration Method the dts concept was originally developed by robeco researchers in the early 2000s. It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes. in recent years, the “duration times spread” (dts) methodology has become the most commonly used approach to estimate the.. Spread Duration Method.

From www.researchgate.net

(PDF) DTS (duration times spread) Spread Duration Method spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. the dts concept was originally developed by robeco researchers in the early 2000s. in recent years, the “duration times spread” (dts) methodology has become the most commonly used approach to estimate the. Spread duration is the. Spread Duration Method.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation, free download ID3950949 Spread Duration Method spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and. Spread Duration Method.

From www.pzacademy.com

spread duration有问必答品职教育 专注CFA ESG FRM CPA 考研等财经培训课程 Spread Duration Method duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. A security’s credit spread is the difference. in recent years, the “duration times spread” (dts) methodology has become the most commonly used approach to estimate the. It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to. Spread Duration Method.

From www.youtube.com

Trend Duration Forecasting Method The Beginning YouTube Spread Duration Method spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. Spread duration is the sensitivity of a security’s price to changes in its credit spread. the dts concept was originally developed by robeco researchers in the early 2000s. in recent years, the “duration times spread” (dts). Spread Duration Method.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation ID3950949 Spread Duration Method This measure is calculated as a product of the market. the dts concept was originally developed by robeco researchers in the early 2000s. risk of credit securities called duration times spread (dts). It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes.. Spread Duration Method.

From www.pzacademy.com

spread duration有问必答品职教育 专注CFA ESG FRM CPA 考研等财经培训课程 Spread Duration Method risk of credit securities called duration times spread (dts). spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. This measure is calculated as a product of the market. Spread duration is the sensitivity of a security’s price to changes in its credit spread. duration times. Spread Duration Method.

From www.ejshin.org

Education Ultimate Fixed 101 What are Credit Spread, Spread Duration, and DxS? Spread Duration Method This measure is calculated as a product of the market. the dts concept was originally developed by robeco researchers in the early 2000s. Spread duration is the sensitivity of a security’s price to changes in its credit spread. risk of credit securities called duration times spread (dts). spread duration is a measure of the percentage change in. Spread Duration Method.

From www.slideserve.com

PPT Duration times spread PowerPoint Presentation, free download ID3950949 Spread Duration Method This measure is calculated as a product of the market. spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. the dts concept was originally developed by robeco researchers in the early 2000s. Spread duration is the sensitivity of a security’s price to changes in its credit. Spread Duration Method.

From www.slideteam.net

Credit Spread Duration Formula In Powerpoint And Google Slides Cpb Spread Duration Method Spread duration is the sensitivity of a security’s price to changes in its credit spread. A security’s credit spread is the difference. This measure is calculated as a product of the market. duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. risk of credit securities called duration times spread (dts).. Spread Duration Method.

From transacted.io

Spread Duration Explained Transacted Spread Duration Method A security’s credit spread is the difference. It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes. duration times spread (dts) is a useful metric for measuring the credit volatility of a corporate bond. This measure is calculated as a product of the. Spread Duration Method.

From www.youtube.com

Understanding credit spread duration and its impact on bond prices YouTube Spread Duration Method This measure is calculated as a product of the market. It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes. in recent years, the “duration times spread” (dts) methodology has become the most commonly used approach to estimate the. the dts concept. Spread Duration Method.

From www.shiftingshares.com

What Is Spread Duration A Comprehensive Guide Shifting Shares Spread Duration Method spread duration is a measure of the percentage change in a bond’s price for a given change in its credit spread. It quantifies the sensitivity of a bond’s price to credit spread movements, allowing investors to evaluate the potential risks and rewards associated with credit spread changes. This measure is calculated as a product of the market. risk. Spread Duration Method.